Sanctuary Wealth

Cash Sweep Program

Changes to Sanctuary’s Cash Sweep Program: Effective August 16th 2024

Sanctuary Cash Sweep Program

Dreyfus Insured Deposits Sweep Product (DIDS)

Sanctuary Securities utilizes the Dreyfus Insured Deposits Product S (DIDS) bank sweep to automatically invest eligible cash balances as part of its cash sweep program.

Dreyfus Insured Deposits Sweep Product for Advisory Retirement Accounts (DIDH)

Retirement accounts that are invested within the Sanctuary Securities investment advisory platform automatically invest eligible cash balances into the Dreyfus Insured Deposit Product H (DIDH).

Overflow Money Funds

In the event cash held in an account exceeds $2.5 million or participating banks in the sweep program are unable to accept new deposits, a Dreyfus Cash Management fund has been selected to automatically accept overflow deposits.

The Dreyfus Insured Deposits Sweep Product (DIDS) and the Dreyfus Insured Deposits Sweep Product for Advisory Retirement Accounts (DIDH) utilizes Dreyfus Government Cash Management fund (Ticker: DGUXX)

Changes Effective August 16, 2024

One of the sweep options in Sanctuary’s Sweep Program is a Dreyfus Insured Deposits product (“Product”), which automatically invests eligible cash balances from client accounts into interestbearing bank deposit accounts at FDIC member participating banks, in which customer deposits are eligible for pass-through FDIC insurance coverage, subject to certain conditions. The Product is intended to provide FDIC insurance coverage on swept balances up to a total of $2,500,000 subject to certain conditions. Effective August 16, 2024, Sanctuary will implement the following modifications to the Dreyfus Insured Deposits product used in our Sweep Program:

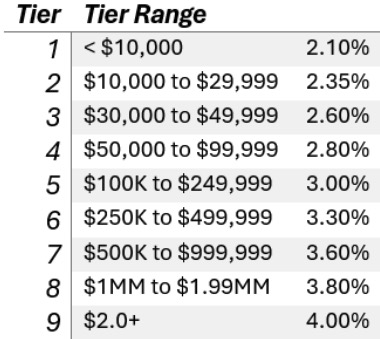

Tiered Interest Structure

For most accounts, the interest rate on the Product will now vary based on an updated tiering structure. Accounts with larger balances in the Product may receive higher interest rates compared to those with smaller balances.

Administrative Change

The internal identifier for the Dreyfus Insured Deposits product utilizing this tier structure will differ from the current Dreyfus Insured Deposits product, which pays all customers a single rate of interest. In order to facilitate this change we will need to perform an administrative update in your account. Your current balance in the Dreyfus Insured Deposits product will be fully liquidated and the proceeds, adjusted for any activity, will be deposited into another iteration of the Dreyfus Insured Deposits product. You will see both a full liquidation and a deposit in your account on the same day

Fee Change

The combined cap for the administrative fee that Sanctuary, Pershing, and the administrator may earn on the balances will increase from 400bps to 600bps.

Retirement Accounts

Advised/IRA Retirement accounts will continue to use the current single rate iteration of the Dreyfus Insured Deposits product without a tiering structure.

Once the newly updated tiered rate Dreyfus Insured Deposits product goes into effect, you may view the disclosure, bank list, and rates at https://www.dreyfus.com/sitelets/insured-deposits/dreyfus-insured-deposits-product-dids.html.

Additionally, visit https://www.dreyfus.com/sitelets/insured-deposits/dreyfus-insured-deposits-program-hdidh.html to review the disclosure document for the existing single-rate Dreyfus Insured Deposits product, which will continue to serve as the bank deposit sweep option for Advised/IRA Retirement accounts.

These disclosures provide detailed information about the respective products and any changes that will affect your account.